Stop dreading your accounts.

Let AI handle it all.

The complete AI accountant for UK Ltd companies. Books, VAT, tax, invoicing, payroll — everything handled.

No credit card required · Free during Early Access

Any input. Automatically processed.

Throw receipts at us however you like.

Snap Receipts

Photo → categorised → done

Forward Emails

Invoices processed automatically

Voice Notes

Talk while driving

Bank Statements

Upload CSV or PDF, auto-parsed

Works with your tools

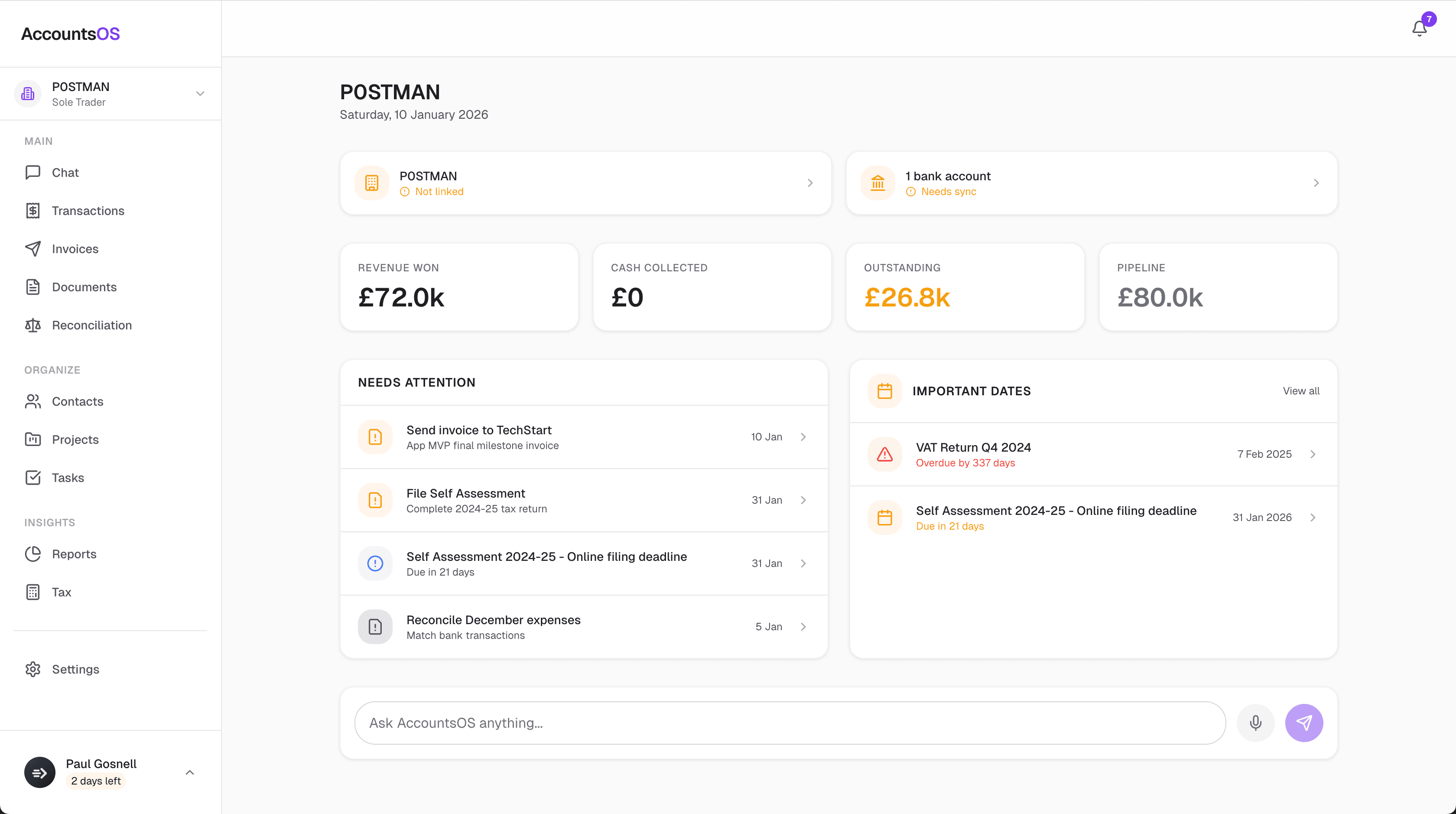

Good morning, Paul

Cash: £12,847. VAT due in 8 days. 2 overdue invoices.

Yes — HMRC allows the simplified method:

25-50 hrs: £10/mo | 51-100: £18/mo | 101+: £26/mo

That's ~£312/year. Shall I log it?

Your accountant, in your pocket

The AccountsOS mobile companion app. Chat with your books, snap receipts, and check your numbers — all from your phone.

One app. Everything you need. Free.

Why pay for accountants, bookkeeping software, receipt scanners, and invoicing separately?

| What you're replacing | Typical cost |

|---|---|

| Accountant | £100-300/month |

| Bookkeeping software | £20-35/month |

| Receipt scanning | £15-30/month |

| Payroll software | £10-20/month |

| Invoicing tool | £10-20/month |

| Traditional total | £155-405/month |

| AccountsOS | Free* |

*Free during Early Access — then just £9/month

Sign up now to lock in £9/month forever when paid plans launch (standard price £19/month)

Everything a UK Ltd company needs

No add-ons. No hidden fees. No accountant required.

Full access to everything

Then £9/month when paid plans launch (standard price £19/month)

Get Started FreeNo credit card required

Powered by